My which insurance companies offer sr22 blog 1870

More About Sr-22 Insurance: What It Is And How To Get Cheap Quotes<

You have to go to the DMV with the form in order to have your license reinstated. You are needed to preserve the SR22 insurance for an assigned quantity of time. Normally this time is in between one and also 3 years yet it is necessary that you preserve it as long as you need to avoid more fees.

Now, because your insurer is the one responsible for sending the real data, they tackle this charge when the declaring is done, then they will bill you separately or add the price to your following insurance bill (car insurance). In some cases you could be required to have SR-22 insurance coverage for several years, in which instance you only pay a charge when for it to be filed the very first time.

Nonetheless, be advised that if there is a lapsemeaning, you did not request the renewal to be refined on timethen you will need to pay once more due to the fact that you will require brand-new evidence of protection. dui. Typically talking, you will certainly need to have this certification of protection for three years. Nevertheless, the real length of time is contingent upon: where you live and also what your state laws are, andwhy the courts needed this protection of you.

If there was a much less hazardous factor, it may be just 2 years. dui. The coverage remains valid for as lengthy as you keep your insurance coverage plan. If, for any reason, you cancel this policy or there was a gap in between revivals, your auto insurance coverage will certainly notify your state authorities.

For instance, if you are asked to have SR-22 for 3 years, but after that you cancel your insurance coverage policy after 2 years, the state will likely suspend your certificate if it had actually been previously suspended. They will certainly then push a metaphorical time out on that 3 year mark and also when you determine to acquire a brand-new insurance coverage policy in the future, they will certainly begin it up once again.

Little Known Facts About Ignition Interlock Device Sr-22 Insurance Costs & Faqs.

The length of time you are needed by your state to lug the insurance coverage can be expanded if, throughout that time, you get into a cars and truck accident or a traffic infraction. The courts can expand the time you need this insurance, which can enhance the cost of your insurance coverage. The factor the cost goes up is due to the fact that added violations tells your insurance policy that you are a high-risk motorist.

(Mon-Fri, 8am 5pm PST) for a or fill out this form: Finding a near you is not difficult. Any type of insurance company in any kind of state can supply this insurance coverage, however not all of them do.

Even if they maintain you on as an insurance holder, they can increase the rate considerably. Insurance companies determine the quantity of money you pay for your coverage based on exactly how safe a vehicle driver you are, which is why many individuals can obtain discounts on cars and truck insurance by taking risk-free driving programs or going several years without offenses or having a digital system track just how safely they drive. bureau of motor vehicles.

These are the top 10 insurance policy service providers for. no-fault insurance. In order to obtain your insurance policy coverage up to day, you will require to obtain a quote for SR-22 insurance policy.

You can obtain a cost-free quote just filling up the form on the top of this page, and in a few mins you'll compare multiple inexpensive SR-22 insurance coverage quotes. Depending upon your state, and also the factor for your violation, you might need to submit added different kinds. SR-21 Insurance coverage, This is a comparable form however it shows that you have evidence of car insurance coverage. sr-22.

Top Guidelines Of Illinois Sr-22 Insurance

SR-50 Insurance policy, If you reside in the state of Indiana this may be the alternate insurance policy you are called for to lug. This is comparable as well as is suggested to aid you obtain your certified renewed after it has been suspended due to the fact that of your offense. (Mon-Fri, 8am 5pm PST) for a of an economical SR22 insurance policy, or fill out this form:.

If your SR22 vehicle insurance plan is terminated, gaps or runs out, your car insurance company is needed to inform the authorities in your state. (They do this by providing an SR26 type, which accredits the cancellation of the policy.) Then, your license can be suspended once again or the state might take various other severe activities that will certainly restrict your capacity to drive - dui.

Failing to keep your insurance protection might trigger you to shed your driving privileges again and also your state might take other actions against you. That's why it's so crucial to obtain trustworthy information and also support from licensed insurance policy agents at respectable SR22 insurance coverage companies.

Plus, experienced representatives will be able to assist you locate an authorized low-cost SR22 insurance plan. If you have more inquiries about SR22 insurance policy or any type of various other product and services, drop in a Straight Auto Insurance policy location near you or call an agent at 1-877-GO-DIRECT (1-877-463-4732). At Direct Auto, you can get the cost effective automobile insurance policy coverage you need, the solutions you want, and also the respect you deserveregardless of your insurance history.

The cash we make assists us give you accessibility to free credit history as well as records and helps us develop our various other fantastic devices and academic materials. Settlement may factor into just how and where items show up on our platform (and also in what order). insurance group. Yet because we generally generate income when you discover an offer you such as and also get, we try to show you supplies we believe are an excellent suit for you.

Some Known Details About Sr 22 Insurance : How Much Does It Cost

Certainly, the deals on our system do not stand for all monetary items out there, however our objective is to reveal you as numerous wonderful options as we can. An SR-22 kind often called a certification of economic obligation or described as SR-22 insurance is a form that your vehicle insurer will submit with your state (insurance).

These types are commonly needed after your license has been suspended and are usually required to reinstate your certificate. The SR-22 and FR-44s type are issued by your insurer. Your insurance firm will typically submit the certification with your state's transportation company. Some insurance companies will certainly file immediately, as well as others will certainly submit upon your request.

The length of time that you'll need to have an SR-22 form on file varies by state but it's normally three years. During this duration, be careful about paying your costs in a timely manner as well as renewing your plan. If your policy gaps or runs out, your insurance provider is called for by legislation to alert the state.

As soon as you have actually had an SR-22 for the needed period of time, this condition should be lifted. But you'll first require to send your SR-22 kind to your state transportation firm to obtain your certificate reinstated if it was withdrawed. There isn't a recurring cost linked with having an SR-22 certification.

It all depends on your insurance policy company as well as the state where your SR-22 will be filed. That's because your auto insurance firm might consider you a high-risk vehicle driver if your driving document includes one or more incidents that led to an SR-22 declaring.

The Best Strategy To Use For Sr22 Insurance Rates In Florida

Yet driving background is just among the variables that can influence your car insurance coverage costs, so it is necessary to look around and also consider your insurance coverage choices thoroughly. A pair of insurance coverage business claim on their websites that an SR-22 filing will certainly have a marginal effect on your premium or no effect at all.

She has greater than a decade of experience as an author and also editor and holds a bachelor's Learn more. Review A lot more.

Claim hello to Jerry, your brand-new insurance coverage agent (insurance). We'll contact your insurance coverage firm, review your existing plan, then discover the insurance coverage that fits your needs and also conserves you cash.

Most of us like to assume we are wonderful drivers. But sadly, errors happen and sometimes poor decisions are made that have enduring effects. As an example, if you are billed with a DUI, you might require to file type SR-22 through your auto insurance provider - liability insurance. Wait, what is an SR-22? Those who aren't knowledgeable about this form in some cases think it is an auto insurance coverage, but that isn't rather appropriate.

If you have a squeaky-clean driving document, do not worryonly those that have actually been charged with specific offenses have to submit an SR-22. An SR-22 is required in the instance of particular convictions, such as a DUI or reckless driving. An SR-22 is not an insurance coverage. It is a type that lets your state recognize you contend least the minimum level of insurance coverage.

8 Easy Facts About Sr22 Filing As Low As $10 A Month! . Low Cost California Sr22 ... Explained

Who requires an SR-22? Not everyone needs an SR-22.

As normal, you can anticipate to pay a $25 single charge to submit an SR-22. If you and your partner requirement SR-22s, you'll pay the charge twice, Worters states.

Simply what you need: an additional fee. You could be questioning simply how much premiums usually increase when you file an SR-22. Guarantee.

That being the case, there is no collection premium boost for those that require SR-22 insurance coverage. bureau of motor vehicles. Where you live in enhancement to your driving record and the sort of car you drive all influence the increase you'll see in your prices. Certainly, violations that suggest high-risk actions, such as a DUI, indicate your rate boost will be steeper.

Unfortunately, the response to the concern of price boosts will never be the same for every person. You will need a personalized SR-22 insurance quote to actually recognize what kind of increase you are facing. SR-22 insurance coverage prices by company No one likes when their car insurance policy prices enhance, however that will likely hold true if you require an SR-22. driver's license.

Farmers Insurance: Insurance Quotes For Home, Auto, & Life Fundamentals Explained

How do you understand your insurance company will file the type? As it transforms out, some insurance providers can't be bothered to do this. Numerous car insurance business don't desire the hassle of filing SR22s with states and likewise filing SR-26s when policies gap, states Alex Hageli, supervisor of personal lines policy with the Residential property Casualty Insurers Association America, an industry trade group (sr22).

https://www.youtube.com/embed/hbxoRP1aVE8

Still, if you have to remove or cancel an SR-22, you need to contact your insurance provider. They filed the SR-22, as well as currently, they will certainly need to file an SR-26. Makes good sense, does not it? The difference in between SR-22 and FR-44 The FR-44 is a different type that is just made use of in Florida and Virginia; these states attempted to be different.

The 25-Second Trick For How Getting An Oregon Dui Impacts Auto Insurance

Do I require an SR-22/ FR-44? Not every person needs an SR-22/ FR-44.

Current Customers can contact our Customer care Division at ( 877) 206-0215. We will evaluate the coverages on your plan and begin the process of submitting the certification on your behalf. Exists a fee related to an SR-22/ FR-44? Many states bill a level cost, yet others call for an additional charge. This is a single charge you have to pay when we submit the SR-22/ FR-44.

A declaring cost is billed for each private SR-22/ FR-44 we submit. For instance, if your partner gets on your plan as well as both of you require an SR-22/ FR-44, then the declaring fee will certainly be billed two times. Please note: The charge is not consisted of in the rate quote since the declaring fee can vary.

Your SR-22/ FR-44 should be legitimate as long as your insurance policy is active. If your insurance policy is canceled while you're still needed to carry an SR-22/ FR-44, we are called for to inform the appropriate state authorities.

When you obtain your permit back, you may have to make use of an ignition interlock tool at your own expenditure for approximately 5 years. You could additionally need to finish a DUI education program. A 2nd The golden state DUI within one decade brings as much as a year behind bars, up to three years without driving privileges, as well as penalties of approximately $1000.

Getting The A New Fractional Vision Explored To Work

Examine this out if you need added details, resources, or guidance on cars and truck insurance. This content is created as well as maintained by a 3rd party, and imported onto this web page to help customers supply their email addresses. You might be able to locate more information regarding this and also comparable content at piano.

SR 22 Insurance coverage There is a selection of kinds of auto insurance policy that you are most likely acquainted with - from liability to comprehensive to accident - however one kind you may not acknowledge is SR22 insurance. SR22 insurance is a certification of monetary responsibility as well as is usually mandated by a court order adhering to a conviction for a significant traffic offense - no-fault insurance.

What is SR22 car insurance policy? Commonly referred to as SR22 auto insurance policy, an SR22 is not in fact insurance, yet rather a certification of monetary duty sent to the Division (DMV) or Bureau of Electric Motor Vehicles (BMV) on the insurance policy holder's behalf. It specifies that the insurance policy holder has actually the mandated coverage restrictions set forth by a court order after an offense.

These offenses may consist of the following: - one of one of the most common reasons for an SR22 mandate is because of a driving under the influence conviction. This puts on those convicted of driving while intoxicated or drunk of medicines that limit the chauffeur's ability. driver's license. - someone who is convicted of a major traffic violation such as driving negligently or recklessly, normally in unwanted of 20 miles per hour over the rate limit, might be required to have SR22 vehicle insurance coverage.

- if a chauffeur remains in an accident as well as doesn't have insurance policy coverage, the court may need them to have SR22 coverage after the mishap. - chauffeurs looking for reinstatement after having actually a withdrawed or suspended license will frequently be called for to have SR22 automobile insurance policy prior to they're granted approval to drive once again.

Some Of How Does A Dui Affect Your New York Car Insurance? - Way

Those who currently have coverage will certainly not require to obtain brand-new insurance unless the company drops them. Once the SR22 is filed with the state, the insurance holder does not need to do anything except keep the protection. SR-22 Insurance Coverage Providers Where to get an SR22 Numerous insurance providers use SR22 protection; the insurance policy holder simply has to request that a copy of their plan be sent to the DMV or BMV, depending upon the state (motor vehicle safety).

If you are bought to lug an SR22, it is a great idea to search for protection. Obtaining SR22 Car Insurance Policy Getting SR22 car insurance policy is a straightforward procedure. As soon as you pick an insurer for your coverage, it can send the filing the very same day you request it.

How will an SR22 affect the price of my insurance policy? This happens because chauffeurs who are required to have an SR22 are considered high-risk by insurance firms.

It is vital to keep in mind that you will be accountable for the price of your insurance deductible if you are associated with an accident so constantly choose a deductible that you can afford - department of motor vehicles. One more method to lower the costs price is to think about the sort of car you drive. Deluxe and sporting activities cars tend to be a lot more costly than sedans and also various other automobiles with high security ratings.

Maintain in mind that some insurance companies provide specific price cuts on premiums so speak to your agent and figure out for what you might certify. no-fault insurance.

How Much Does Austin Sr22 Insurance Cost? Things To Know Before You Get This

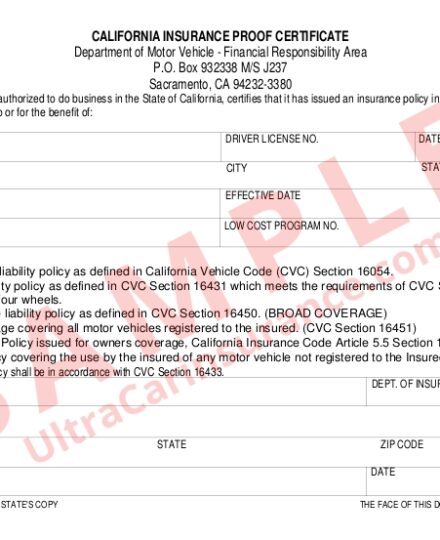

If you're in trouble in California due to the fact that of being uninsured in an accident or getting a DRUNK DRIVING, you could be called for to show you have cars and truck insurance policy with a form called an SR-22. An SR-22 is a certification, called a California Insurance Policy Proof Certificate, that your insurance company data with the California Department of Motor Vehicles. auto insurance.

See what you can minimize vehicle insurance, Conveniently compare tailored prices to see how much changing auto insurance might conserve you. insurance. If you don't obtain an SR-22 after a major violation, you might shed your driving privileges. Here's why you might need one and also just how to find the most inexpensive insurance rates if you do.

Just how to obtain an SR-22 in California, Filing an SR-22 isn't something you do on your very own. California needs insurance providers to electronically report insurance info to the DMV - department of motor vehicles.If you require an SR-22, ask your insurer to submit one on your part if it will. Some insurer do not submit SR-22s.

Our evaluation located that some insurance companies supply cheaper coverage, so it pays to go shopping about as well as compare auto insurance quotes. Our analysis of the least expensive insurance companies after a drunk driving found that: The golden state's 5 most affordable insurers enhance yearly minimum coverage prices a standard of $227. Grange Insurance coverage Organization returned the most inexpensive typical minimum insurance coverage price after a DRUNK DRIVING, at $723 a year or $60 a month.National General, which intends to give budget-friendly insurance policy for drivers with one DUI on their documents, had the tiniest boost in average price out of the team, including just over $38 to the typical minimum rate for chauffeurs with a DUI, at $725 a year or $60 a month.

Due to the fact that insurance firms make use of various factors to rate rates, the most affordable insurance firm prior to an offense probably won't be the least expensive after. Our evaluation found that while Geico had the cheapest typical annual rate for a good driver with minimal coverage, after a DUI the rate raised by greater than 150%, pushing the company out of the leading five cheapest firms for an SR-22 in California. sr22.

Unknown Facts About How A Dui Or Dwi Can Affect Your Car Insurance - Investopedia

An SR-22 is a form your insurance firm submits with the DMV to verify you have the minimal liability vehicle insurance protection your state calls for - credit score. After being founded guilty of a major web traffic violation, such as DUI or driving without insurance, you are called for to file an SR-22 to prevent your permit from being revoked or put on hold.

You'll locate response to these concerns: Just how much does an SR-22 cost? Many vehicle insurance provider charge a charge to submit an SR-22 type for you. liability insurance. This fee normally is between $15 and also $50, and also will reveal on your insurance costs as an one-time cost. You won't pay this fee annually.

Serious criminal activities like Drunk drivings are more probable to sustain a significant walking in your costs than speeding. Insurance coverage requirements are regulated on a state-by-state basis. States that have high populace thickness, varieties of without insurance chauffeurs (such as Florida) or minimum protection demands, have several of one of the most costly auto insurance coverage rates in the nation. insurance companies.

If they can't or will not, look elsewhere. You'll be asked to pay an one-time cost for filing an SR-22, around $15 to $50. After you make your repayment, your insurer will submit the SR-22 in your place to your regional DMV. You ought to receive a confirmation letter once the procedure is complete, so see to it you keep it on record.

Contrast companies to get the least expensive SR-22 insurance prices - insure. See exactly how much you could save with a brand-new plan What is an SR-22? An SR-22 is a "certification of economic duty" your insurance coverage business will tack onto your policy to confirm that you meet the state minimum auto insurance policy requirements.

The smart Trick of Best Cheap Sr-22 Insurance Rates In California That Nobody is Talking About

You aren't needed to obtain an SR-22 unless you receive several traffic citations or are condemned of a serious website traffic offense. Chauffeurs who have been involved in serious roadway incidents are normally needed by their state DMV to file an SR-22 as a fine. Do you require SR-22 insurance? States need you to obtain SR-22 insurance or data SR-22 kinds due to the fact that they want assurance you can spend for any damage you may trigger while driving.

In the event you're condemned of another significant driving violation, you might be required to maintain your SR-22 form for also longer. Your insurance company does not automatically eliminate your SR-22 form once the moment limitation mores than (motor vehicle safety). When you call your insurer, you ought to additionally ask if you can get a brand-new rate.

Do I need to submit an SR-22 if I don't have a cars and truck or have a vehicle driver's permit? Yes, if the state or a court says you require an SR-22, you require to file the type, no matter of whether you have a vehicle or a permit. Chauffeurs without a vehicle can meet the SR-22 demand by obtaining nonowner vehicle insurance coverage (no-fault insurance).

One is to allow your insurance policy company understand your SR-22 filing duration has actually ended and also you no more need SR-22 insurance policy. Another is to let the DMV recognize you terminated your vehicle insurance plan very early or your insurance provider terminated it for you, as well as prior to your SR-22 period ended. LLC has actually striven to ensure that the information on this site is appropriate, yet we can not guarantee that it is devoid of errors, mistakes, or omissions.

Quote, Wizard. com LLC makes no representations or service warranties of any kind, reveal or implied, as to the procedure of this site or to the details, material, products, or items consisted of on this website (no-fault insurance). You specifically concur that your use this website is at your single risk.

Some Ideas on How Much Is Sr22 Insurance On Average? You Need To Know

Who Demands SR-22 Insurance Policy in California? Not every chauffeur needs to submit an SR-22 Form in California.

https://www.youtube.com/embed/WYSpNfenfp4

Nonetheless, you can opt-out of buying these insurance coverage coverages as long as you state your refusal in writing. At the minimum, you require to satisfy the responsibility insurance coverage requirements in California. Everything else is optional, however it is extremely suggested that you purchase complete coverage for on your own as well as your car.

The Ultimate Guide To How Much Is Sr22 Insurance On Average?

You don't also have to do it yourself, we will submit it for you. The filing fee is a single fee that you will require to pay when the insurer files the SR-22.

Along with the declaring cost as well as any additional charges, all of it comes down to the reason that you were needed to have an evidence of financial responsibility in the very first area. Generally, its due to one of the following: driving intoxicated driving without insurance policy creating a mishap repetitively travelling website traffic violations Those incidents go on your driving record, and also all of the insurance provider have access to it.

In many cases, having to submit SR22 Kind indicates you will certainly remain in a group. auto insurance. The bright side is that this is just short-term. You must examine with the regional authorities to discover just how long you require to bring SR22 insurance policy and if the minimal obligation limitations have been met.

You need to contrast quotes from a minimum of 3 various insurer. You can conserve a lot of money and time by allowing us contrast your prices with every one of the business that we stand for. Austin Insurance policy Group represents even more than 15 different firms that provide Austin SR22 protection in Texas.

An SR-22, generally referred to as SR-22 insurance policy, is a certification provided by your automobile insurer giving evidence that you carry the called for minimum amount of car obligation insurance coverage for your state. sr-22. If you have actually been involved in an accident as well as were not lugging minimum vehicle insurance policy, a lot of state DMVs will require you to file an SR-22.

If a vehicle driver is needed to carry SR-22 and also she or he relocates to one of these six states, they have to still remain to fulfill the demands legitimately mandated by their former state. All lorries in Washington and also Oregon need to bring a minimum obligation insurance plan. If a Washington motorist has his/her license suspended, the motorist should supply evidence of economic responsibility by submitting an SR22 - insurance.

The smart Trick of Compare Cheap Sr-22 Car Insurance Quotes Near You That Nobody is Discussing

It is very suggested that the insured renew their policy at the very least forty-five (45) days in advance. There are 2 (2) methods to avoid having to get an SR-22 Washington endorsement. A motorist can make a deposit of $60,000 to the State Treasurer or obtain a guaranty bond with a surety business such as Vern Fonk that is accredited to do business in Washington as well as Oregon - no-fault insurance.

Below are some manner ins which you can avoid needing SR22 insurance policy. Don't consume alcohol as well as drive. This may look like a simple and also easy principle, however millions of people still do it each year. Just one drink might put you over the legal limitation. Discover what your alcohol limitation is according to your weight as well as ensure you remain under (dui).

If you have actually currently had a DUI or DWI, make certain you locate responsible methods to enjoy when driving that DO NOT include alcohol. Do not drive without insurance. This is not just high-risk for you however for various other motorists when traveling. Pay your tickets as well as penalties so that your motorists permit is not withdrawed.

This is constantly a much better option than having your drivers certify taken away. You ought to obey website traffic regulations and also try to drive as securely as possible.

Constantly have you evidence of insurance coverage and also auto enrollment offered. It is illegal to not have proof of insurance while driving. Below are the states that do not call for SR22: Also if these states do not need this declaring, you have to keep SR22 insurance coverage if you are transferring to a state that needs it - sr22.

When you make the proper options, documents for SR22 and keep an excellent driving record, you will as soon as again get your life back on track. The cost for this declaring is normally under $50.

The 9-Minute Rule for Sr22 Insurance: Cost & Cheap Sr-22 Insurance Quotes - 101

You will need this insurance coverage for 3 years - ignition interlock. Despite the fact that this might cost you more, in the long run, you will be pleased to recognize that your SR22 insurance policy can be dropped and also you can advance as a regular driver. A DUI nevertheless does occupy to 10 years to leave your record.

After that, the SR-22 does not cost you any kind of money, however, the reason for needing an SR-22 will most of the times create a boost in underlying insurance rates. The normal period of needing an SR-22 is 3 years yet that differs by state. It is necessary to keep in mind that any relocating violations while under the SR-22 declaring would nearly absolutely prolong the duration for which it's needed.

On one end of the spectrum is several smaller offenses like speeding tickets that can see a rise of around 30% while the various other extreme would certainly be a drunk-driving associated mishap which can be closer to 135% increase (bureau of motor vehicles). Many major firms provide SR-22 policies to its motorists but there are still a few that don't.

While not all companies that supply the filing designation supply it in all states, below's a checklist of one of the most remarkable firms that do supply it in most. GEICO State Farm Esurance Nationwide USAA Farmers insurance AARP Allstate Progressive American Household Insurance Policy While one of the most typical sort of certificate of financial obligation is the SR-22, there are variants utilized depending on the state along with the intensity of the event for which the SR-22 is bought.

An additional variant is the FR-44 which is made use of by a pair other states. It coincides as the SR-22 except an extra severe variation. This kind calls for the vehicle driver to have double or a lot more the minimum liability coverage. insurance companies. The intent of the SR-22 as well as its variations are to ensure the chauffeur has insurance coverage in all times as they have proven to be a better threat to those around them.

See the chart listed below for a full checklist of states and their particular forms.

Welcome To Bristol West Insurance Group Can Be Fun For Anyone

Risky motorists in Nebraska might be called for to purchase SR-22 insurance policy after specific web traffic infractions. Regardless of the name, SR-22 insurance policy is not in fact a cars and truck insurance plan. Instead, an SR-22 is a certificate that shows to the state that you carry a minimum of the minimum amount of auto insurance coverage that is required.Nebraska cars and truck insurer may provide SR-22s as evidence of insurance coverage for high-risk chauffeurs. If you are required to file an SR-22 or a related form, it might have a substantial effect on your car insurance policy price, as well as you could intend to prepare to pay additional costs. What is"SR-22 insurance?"SR-22 insurance is not in fact insurance. An SR-22 is a proof of insurance type that your vehicle insurer files with the Nebraska Department of Motor Automobiles (DMV). To acquire an SR-22 in Nebraska, you should have an auto insurance policy that satisfies or exceeds the state's minimum demands. You'll require to call your car insurance policy firm and request for the kind to be filed with the DMV in your place (insurance). Nevertheless, not all car insurance policy service providers will certainly submit SR-22s; even several of the very best cars and truck insurance policy companies will not insure high-risk drivers. SR-22 Nebraska choices, Similar to vehicle insurance policy rates vary by state, so do vehicle insurance policy recognition forms. Most states use the SR-22 to verify insurance coverage for high-risk motorists, yet some locations of the country use alternative kinds. Generally, the kind kind depends on the type of offense and whether the motorist has actually dedicated numerous offenses.: The SR-21 type is utilized in a few states to verify that a motorist was covered at the time of a mishap or ticket.: The SR-22A form is comparable to an SR-22, however needs that the motorist compensate front for an extensive duration of car insurance coverage, usually six months. Maryland is the only state that utilizes this kind, which verifies coverage for 30 days.: Indiana uses the SR-50 form to validate a motorist's cars and truck insurance protection at a day in the past. Non-owner SR-22If you require an SR-22 declaring but you do not own an auto, you may initially require to buy a non-owner vehicle insurance coverage. A non-owner SR-22 certificate is scheduled for people who do not possess a lorry. The insurance coverage requirements for a Nebraska SR-22 and also a non-owner SR-22 coincide, and both kinds will certainly remain on your record for the exact same quantity of time, depending on the nature of the offense. SR-22 Nebraska insurance policy expenses, If you need an SR-22 in Nebraska, you might intend to get ready for some costs. If you finish up in court, you could also need to pay for your lawyer expenses as well as settlement costs.

After that, you will likely pay an SR-22 declaring cost, which is normally less than$50. For every single year that the SR-22 should continue to be on your record, you will most likely additionally have to pay a revival fee - car insurance. This isn't because of the SR-22 itself, however instead because of the driving infraction that resulted in you requiring the SR-22 . If your costs rise implies your insurance is as well pricey, you might wish to search and also locate a cheaper cars and truck insurance provider. Finally, chauffeurs who require SR-22 insurance policy should additionally be prepared to pay a permit reinstatement cost. Regularly asked concerns, For how long do I require an SR-22 in Nebraska? In Nebraska, the amount of time you will have an SR-22 depends on the type of violation dedicated. In a lot of scenarios, you will require to have the SR-22 for around 3 years. If you get associated with one more serious infraction while you have the SR-22 on your document, it is feasible that you could be required to maintain the certification for longer. The insurance policy firm will certainly submit the kind straight with the state, either by mail or electronically, and may provide you with a duplicate - underinsured.

Exactly how much does SR-22 insurance policy expense in Nebraska? An SR-22 declaring cost is normally much less than$50. SR-22s are kinds, not insurance coverage. You'll likely see a rise in your automobile insurance coverage based on the driving infraction that motivated the requirement for the SR-22. Only chauffeurs that get popped for a drunk driving will certainly be asked to include an SR-22 - sr22 insurance. SR-22 is the name of the kind your Department of Motor Automobiles asks you to include in your auto insurance coverage, it is not in fact a kind of insurance. If you are convicted of Driving Under the Impact, your car insurance policy will certainly get a great deal extra expensive. SR22 insurance is typically called for in order to continue driving legally in your state. You may be asking yourself or' Just how much does SR22 cars and truck insurance policy price per month

?'In this short article, we will deal with the typical expense of SR22, exactly how to get it, and just how long it takes to place right into location. This form is required by your state to verify you have the proper quantity of responsibility coverage. It is likewise in some cases described as a CRF, or Certificate of Financial Duty. If you reside in the state of Florida or Virginia your state might need what's referred to as a FR44 rather than a SR22. Texas SR22 Insurance Policy: Take a 32 hr repeat wrongdoer program. If you do not possess an auto, yet need to submit an SR22 with the state in order to maintain your drivers permit, you can purchase one of these really cost effective plans. sr22 insurance.

What Does SR22 Insurance Coverage Cover? If you are needed by your state to file a SR22 kind it's most likely as a result of one of the following factors: DUI or DWIAccidents while without insurance Obtaining your certificate revoked or suspended, Significant or repeat web traffic offenses, Driving with a put on hold permit, Needing a challenge permit, Not paying kid assistance, The SR22 will permit you to keep your license and also enrollment and also is typically required for at the very least 3 years, but in some cases is required for approximately 5 years. Change and reduce typical $750/yr - auto insurance. Bundle and also save much more! Compare best rates on the internet in minutes! Contrast quotes fast, very easy, as well as complimentary! Where & Exactly how Do You Get SR22 Insurance Policy? In order to get SR22 insurance coverage, you can click one of the web links on this page

as well as finish the quote form. Or you can call your current insurance coverage provider. If they don't provide the option to file a SR22 or you aren't presently insured, then you will have to locate an insurance coverage business you can acquire insurance coverage through that additionally has the choice to file a SR22. If you're not sure, a fast search online can allow you understand if your company can submit a SR22 on your part. Info Needed to Get SR22 Insurance Coverage? The insurance coverage company that you acquire your SR22 insurance policy with will require your chauffeur's certificate or other identification number. Depending upon the state there might be added information called for also. The length of time Does it Require To Alert the DMV? Insurance business can commonly file and submit the SR22 types within the same day to your state's department of motor cars, yet it's possible that it might occupy to one month to be filed. You will certainly require to, also if you market your auto - insurance group. Hence the name: non-owner auto insurance coverage. You are a non owner, yet still have automobile insurance coverage. You can most likely to a business like Progressive as well as acquire a Non, Owner SR22 Automobile Insurance Coverage. This car insurance plan will certainly offer you with liability protection for any type of automobile you drive, but do not own. They are cheaper due to the fact that the car insurance provider thinks you don't drive extremely commonly. They will submit the SR22 with your state's Department of Motor Cars and also you will not lose your vehicle drivers permit. Do not Choose Your First Quote. Contrast Providers & Look Around For the Ideal Rate in Under 2 Minutes. If you cancel your insurance coverage while you are still needed to have.

Little Known Facts About Florida's Sr22 Insurance Agency.

SR22 then your company is called for to report you to your state and you can lose your permit. department of motor vehicles. If you relocate to a brand-new state that does not call for SR22 you still need to keep your SR22 filed with your former state and also therefore will certainly need an insurer that can do organization in both states. Is SR22 An One-Time Cost? The typical declaring charge is$

https://www.youtube.com/embed/RLn-Uky96ec

25, however it can be extra or much less depending on the insurer finishing the declaring. Generally it is not more than$50. Once you have filed a SR22 you do not need to submit a new one each year as it will last the period the SR22 is called for. While the first shock of the month-to-month cost is quite alarming, if you maintain your driving record tidy, the need to carry itwill eventually finish. What is an SR-22? Often described as"SR-22 Insurance ", an SR-22 is often needed for vehicle drivers that have actually had their chauffeur's licenses put on hold because of: DUI/ dui sentences Numerous traffic offenses Driving without insurance License plates being ran out A high number of points on a driving record An SR-22 is a certification of financial responsibility that is submitted with the Illinois Assistant of State's workplace. United Vehicle Insurance Coverage offers same-day car insurance. The certificate informs the State of Illinois that you have liability insurance coverage and if your protection is terminated or expires. As this can be a complicated process, we gave some response to often asked concerns regarding SR-22 Insurance. If you require a quote for your SR-22, please obtain a cost-free quote. We will certainly make sure that you have an up to day cars and truck insurance coverage plan to go along with the SR-22. Get the least expensive price as well as Get a cost-free SR-22 insurance policy quote now.Sent directly to the Illinois Assistant of State workplace and also can use up to thirty days to procedure. Just how much does an SR-22 cost? At UAI, there is not an additional cost for your Illinois SR22 filing. Nevertheless, you need to first buy Obligation or Full Protection insurance coverage and the price will certainly depend upon your age, driving document, kind of vehicle, and also added insurance coverage elements. Be sure to call United Vehicle Insurance coverage for a quote on the most affordable rate. For an SR-22 quote, obtain a free quote currently. United Car Insurance policy is the vehicle insurer right here to help you with your car insurance requires. Offer us a telephone call at 773-202-5000 or get a cost-free quote today. Obligations are met, the SR-22 statuswill be removed. During that time, it will be essential to revisit your insurance with United Auto Insurance and also ensure that you remain to stay covered. United Car Insurance Policy is here for you on the occasion that you need an SR-22 certification as well as insurance plan. Bad points can occur to good people, so we understand that having the best team in your corner to help you get rid of up any blunders is very important. The very best means to manage an SR-22 requirement is to call us quicker as opposed to later to prevent any kind of higher threats as well as understand that you are covered. This info is suggested for academic objectives and also is not planned to change information gotten via the pricing quote process. This details may change as insurance plans as well as protection adjustment. The factors you might require an SR-22 include severe traffic offenses for which the state may otherwise not enable you to drive. To put it simply, it is a method to begin restoring your driving privileges after they have been revoked or put on hold. The reasons for an SR-22 include: If you obtain a DUI or a DWI(driving while intoxicated ), chances are you'll need an SR-22 to come back when traveling. When the state has actually put on hold or revoked your license, an SR-22 will belong to the procedure of. Recognize what tips the state requires you to take in order to renew your chauffeur's certificate. You'll probably require to take a protective driving course as well as pass a test in order to progress, which will certainly not just help you get your license back but

Facts About Ignition Interlock Uncovered

Just how does SR22 insurance coverage without a cars and truck in The golden state work?Non proprietor insurance coverage works in a different way than owner-operator insurance. Non-owner insurance coverage covers you when you drive a borrowed auto on a periodic basis. This sort of insurance coverage has protection limitations as well as constraints on the kinds of lorries you can drive. High threat non proprietor SR22 The golden state is additional insurance policy protection that pays insurance claims not covered by the car owner's insurance coverage.

The amount of time called for depends on the intensity of the violation. You'll have to maintain this insurance coverage present, or the state will certainly suspend your permit again. Call us or click to begin an on-line quote today.

insurance group dui credit score vehicle insurance sr22 insurance

insurance group dui credit score vehicle insurance sr22 insurance

However, if the cars and truck is not covered by collision and also detailed protection, simply ensure you can afford to replace the automobile if a crash happens. Other methods to save cash on your costs so you gain from economical SR22 insurance coverage is by selecting a greater deductible. Your monthly price is lower when you choose a high insurance deductible, but you'll need to pay more out-of-pocket if you remain in an accident. sr-22 insurance.

An SR-22 is not a real "kind" of insurance coverage, but a form submitted with your state. This kind serves as evidence your auto insurance coverage plan fulfills the minimal liability insurance coverage called for by state law - liability insurance.

Do I require an SR-22/ FR-44? Not everyone requires an SR-22/ FR-44. Laws differ from one state to another. Usually, it is required by the court or mandated by the state just for specific driving-related offenses. : DUI convictions Careless driving Crashes caused by uninsured drivers If you require an SR-22/ FR-44, the courts or your state Motor Car Department will notify you.

Is there a fee linked with an SR-22/ FR-44? This is an one-time fee you should pay when we submit the SR-22/ FR-44 (insurance companies).

The 8-Second Trick For Sr-22

A declaring cost is charged for every individual SR-22/ FR-44 we submit. If your partner is on your policy and also both of you need an SR-22/ FR-44, after that the declaring cost will certainly be charged two times. Please note: The cost is not consisted of in the price quote because the declaring charge can vary.

sr-22 sr22 insurance car insurance underinsured department of motor vehicles

sr-22 sr22 insurance car insurance underinsured department of motor vehicles

Your SR-22/ FR-44 ought to be valid as long as your insurance coverage plan is energetic. If your insurance plan is terminated while you're still needed to lug an SR-22/ FR-44, we are called for to inform the proper state authorities. motor vehicle safety.

Non-owner policy is automobile insurance for non-vehicle proprietors. This kind of plan covers if you are in an accident while driving somebody else's vehicle. You should think about obtaining non-owner vehicle insurance if you borrow or lease cars and trucks quite commonly or if you don't possess a car however need to submit an SR-22 form.

Non-owner cars and truck insurance policy offers responsibility protection to chauffeurs that don't have a vehicle but still need insurance policy coverage. According to Insurance coverage.

sr-22 insurance driver's license insurance companies sr22

sr-22 insurance driver's license insurance companies sr22

However non-owner cars and truck insurance policy supplies obligation insurance coverage for motorists that require cars and truck insurance without an automobile. It spends for injuries and damages you trigger in a mishap when you're driving a vehicle that someone else possesses (liability insurance). Non-owners cars and truck insurance policy commonly enters play as a secondary coverage if the automobile proprietor's insurance falls brief in paying for the repair and also clinical expenses.

Let's state your non-owner's policy has $40,000 in residential property damage liability, as well as the owner of the automobile you're driving has $20,000 in home damages responsibility. You obtain the car and also create an accident with $30,000 in problems, leaving $10,000 to be paid by you (or your pal). Your non-owner's policy would cover the extra $10,000 since your limits are higher as well as you have protection.

Insurance Can Be Fun For Anyone

If this holds true, your non-owner policy is likely to cost you more than it would for someone with a tidy record. Chauffeurs might be considered "high-risk" if their document consists of: A DUI conviction, Negligent driving, Multiple web traffic offenses within a short time structure, Driving without insurance policy, If you're looking for certificate reinstatement, your state might require greater liability limits than it provides for others (auto insurance).

In some instances, it might be essential to submit an SR-22 type with your state. Filing a non-owners SR22 insurance coverage type will not include in your car insurance plan expense, yet the insurance company may bill a. The adhering to table provides instance auto-insurance rates for chauffeurs in Southern California. It compares and offers liability protection quotes for both a car proprietor and a non-owner.

You desire to contrast quotes zip code from at least three insurance business to see that has the most affordable price. Among the significant carriers evaluated by Insurance coverage.

It supplies responsibility protection if something takes place as well as covers you when you are at fault for triggering damages or injury to other individuals. Nevertheless, it will certainly not give insurance coverage for your own injuries or damages that happens to the auto you are driving. What does a non-owner cars and truck insurance plan cover? Liability insurance covers injuries or building damages that you're legitimately liable for as an outcome of a car mishap.

If your state has actually required that you submit an SR-22 or FR-44 monetary duty kind, the state may dictate what liability protection amount you need to obtain. sr22 insurance. In certain states, non-owner car insurance can supply clinical or without insurance driver coverage. Non-owner insurance policy does not include the list below kinds of insurance coverages: Comprehensive, Collision, Towing repayment, Rental reimbursement, Your non-owner liability coverage can be utilized as additional protection if you obtain somebody's vehicle and also are in a car crash; the cars and truck owner's car insurance policy works as the key insurance coverage.

There are a few things that non-owner auto insurance coverage does not secure against: You won't be covered if you're in a crash that causes damage to the lorry you occur to be driving at the time. This suggests that if you obtain your pal's cars and truck as well as obtain into a minor car accident with one more lorry, the vehicle's proprietor can file a case under their very own car insurance policy, or versus the other driver's vehicle insurance policy (deductibles).

All about Sr22 Coverage

The policy will not cover any clinical costs or lost incomes that you may experience as a result of injuries sustained in an accident. Non-owner automobile insurance coverage just covers the person who bought it. It does not supply coverage to various other individuals in your family, like your spouse or others. If you are utilizing your automobile for job, like supplying plans, non-owners vehicle insurance plan will certainly not cover you.

Some vehicle insurance provider will not enable you to get a non-owner plan if there are also numerous primary chauffeurs and automobiles provided on a plan. If a plan provides three chauffeurs as well as three cars, and you are among the motorists, you will certainly be detailed as the main driver on the 3rd lorry and also will not be able to buy non-owner car insurance - credit score.

Comply with these steps to get non-owners insurance, Call a vehicle insurer representative about the protection. If non-owners sr22 insurance policy is called for, offer the representative with your state notification number (if relevant-- not all states need this). Supply standard driving history. Receive details on available firms and insurance coverage rate quotes.

This indicates that you have a monetary rate of interest in the vehicle and also will lose cash if the lorry endures damage - dui. It also decreases the threat of you dedicating insurance coverage scams. What is Non-Owner SR-22 Insurance Coverage? Non-owner SR-22 insurance is a type of car insurance policy for drivers that do not have an automobile yet are called for to have SR-22 insurance policy.

What happens if I have non-owner vehicle insurance coverage View website and I buy a car? If you have an automobile, it's important to acquire the right kind of insurance policy. auto insurance.

If you drive various other individuals's autos often, it might be a great suggestion to get non-owner car insurance. Can you lease an automobile without insurance policy? Yes, you can rent out a car without having vehicle insurance. Rental cars and trucks come with some type of responsibility protection that will certainly secure you in instance something goes incorrect while driving the lorry.

Insurance Coverage - Questions

If you borrow cars periodically, the owner's insurance ought to cover you. If you lease automobiles or drive a person else's auto frequently, it might be an excellent concept to obtain non-owner automobile insurance policy.

What is Non-Owner SR22 Auto Insurance Coverage? If you do not possess a car, you will certainly still require to buy this type, although it will certainly then be a non-owner SR22 type, also referred to as a driver or named-operator plan.

What is Included in a Non-Owner SR22? Non-owner SR22 consists of standard obligation insurance coverage, yet does not include accident protection. This would certainly cover bodily injury obligation and residential or commercial property damages liability. (Learn more concerning responsibility coverage here) This is the state minimum coverage and also only covers other people and also their vehicles. You are not covered, however you are shielded from obtaining a ticket or certificate suspension you would certainly get if you were driving without this insurance policy protection. insurance group.

insure bureau of motor vehicles driver's license insurance companies insurance group

insure bureau of motor vehicles driver's license insurance companies insurance group

You can either Get a quote today online or if you want to speak to one of our qualified representatives, offer us a call to ready up with that said policy at 888-449-0171. It only takes a couple of mins to establish your policy and ensure you are covered (vehicle insurance).

Not owning a vehicle has its benefits. You don't need to fret about maintenance, as well as you do not have to pay enrollment costs. Nevertheless, even if you do not possess a cars and truck, you might still drive in the state of Colorado. If you're a high-risk chauffeur without an auto who needs to reinstate your permit, you might need to obtain non-owner insurance policy in Colorado.

Colorado requires risky chauffeurs that don't possess a car to reveal this evidence of insurance policy. If you've had your permit put on hold, you'll need to produce an SR-22 to obtain it restored. High-risk drivers may consist of those that have been in several accidents over a brief duration or someone that has numerous factors on their certificate.

The smart Trick of Driver's License That Nobody is Discussing

If your plan lapses during that time, you need to begin the three-year term over once again. If you're under probation, you need to maintain the SR-22 type for the duration of your probation. Check out your court paperwork to figure out the timeline you should adhere to - dui. Insurance expenses vary depending on where you get your insurance coverage.

auto insurance insurance bureau of motor vehicles no-fault insurance insurance coverage

auto insurance insurance bureau of motor vehicles no-fault insurance insurance coverage

https://www.youtube.com/embed/ffHnSJb2ENA

Non-owner SR-22 insurance policy is a sort of car insurance policy that is designed for motorists that are called for to have SR-22 insurance policy but do not possess a cars and truck. You might have to get among these plans in order to reinstate your driving opportunities after a permit suspension. Although most insurers can theoretically use you SR-22 insurance coverage without a cars and truck, you might need to choose an insurance coverage firm that specializes in supplying policies for high-risk motorists.

4 Simple Techniques For Sr22 Insurance In Chicago, Illinois

If you received a drunk driving you will certainly be required to get this kind to reinstate a suspended license. If you are required to obtain this form your insurance policy will cost even more than chauffeurs with ideal records - no-fault insurance. SR22 Type, Nevertheless, you must still take a look around permanently insurance coverage prices instead of going for the least costly answer.

If you are called for to obtain this type due to a DUI sentence it will certainly cost you more than if you were needed to obtain the form since of unsettled parking tickets. You will require to buy obligation insurance coverage for a car which you possess if you need to get an SR-22 declaring.

If you have actually just recently had your certificate put on hold or you are taken into consideration a "high danger" vehicle driver, but you do not possess a car, you can still acquire this kind of insurance policy under the heading "non-owner protection". This implies that if you lease an auto or obtain an automobile from your friend, you still have the insurance coverage you are legally called for to have.

Hard, yet not difficult. (Mon-Fri, 8am 5pm PST) for a or load out this type: A lot of the time you will certainly discover that you require this insurance coverage when you are attending an administrative court hearing after you have had your permit taken away or at encountering a probationary driving period.

At this point, you, as the driver in question, have to alert your insurance firm that the judge has made this request. At this point your auto insurance will certainly submit the kind formally with your state DMV on your part.

The smart Trick of Maine Sr-22 Insurance: What It Is And How Much It Costs That Nobody is Discussing

Digitally submitted forms are refined much faster than general delivery (sr-22). Remember to request this from your vehicle insurance coverage quickly after a court or court has actually asked due to the fact that there are state due dates for processing it, and also if the DMV does not process it promptly due to the fact that they received it late, you are the one that gets punished.

division of motor vehicles coverage sr-22 insurance deductibles vehicle insurance

division of motor vehicles coverage sr-22 insurance deductibles vehicle insurance

Do not wait. Take into account that it might take your DMV as much as 2 weeks to process and also ask your insurance policy the length of time it will take them. In order to restore your permit you must pay a reinstatement cost as well as any various other fines linked with your driving record (sr22).

ignition interlock sr-22 coverage no-fault insurance department of motor vehicles

ignition interlock sr-22 coverage no-fault insurance department of motor vehicles

You need to most likely to the DMV with the type in order to have your permit reinstated. Nevertheless, you are needed to preserve the SR22 insurance coverage for a marked quantity of time. Generally this time around is in between one and also 3 years but it is essential that you keep it as long as you require to avoid more costs.

Now, considering that your insurance coverage business is the one responsible for submitting the actual data, they tackle this charge when the declaring is done, then they will certainly bill you independently or include the expense to your next insurance expense. Sometimes you could be called for to have SR-22 insurance coverage for several years, in which case you only pay a cost once for it to be filed the very first time.

However, be advised that if there is a lapsemeaning, you did not request for the revival to be processed on timethen you will certainly need to pay once more because you will need new evidence of coverage. Normally speaking, you will require to have this certificate of coverage for three years - driver's license. Nonetheless, the actual length of time rests upon: where you live and also what your state legislations are, andwhy the courts needed this coverage of you.

5 Simple Techniques For Cheapest Florida Sr22 Insurance - As Low As $8 / Month!

If there was a less harmful factor, it may be just 2 years - coverage. The insurance coverage continues to be valid for as long as you preserve your insurance coverage. If, for any kind of reason, you cancel this policy or there was a lapse in between renewals, your auto insurance will alert your state authorities.

For instance, if you are asked to have SR-22 for 3 years, but then you terminate your insurance policy after 2 years, the state will likely suspend your license if it had been previously put on hold. In addition, they will then press a figurative pause on that three year mark and when you make a decision to buy a new insurance policy in the future, they will certainly start it up once more.

The size of time you are required by your state to lug the insurance coverage can be prolonged if, during that time, you enter into a car accident or a web traffic offense. The courts can extend the moment you need this insurance, which can raise the expense of your insurance policy. The factor the cost increases is since added violations informs your insurance that you are a risky vehicle driver.

If you pick an AAMVA declaring online then this will certainly be immediately done at the end of your called for time. Any type of insurance service provider in any kind of state can provide this protection, yet not all of them do.

Larger business consist of,,, and also. If they will certainly not cover you, there are alternate insurance providers such as,,, as well as. These are the leading ten insurance policy carriers for - department of motor vehicles. To get your insurance policy coverage up to date, you will certainly require to get a quote for SR-22 insurance policy.

Getting My Can I Get An Sr22 When I Don't Own A Car? - The Zebra To Work

You can get a free quote just loading the kind on the top of this page, and in a couple of minutes you'll contrast numerous budget-friendly SR-22 insurance quotes. Relying on your state, and the reason for your infraction, you could have to submit extra alternate kinds. SR-21 Insurance policy, This is a similar kind yet it demonstrates that you have evidence of auto insurance coverage. deductibles.

SR-50 Insurance coverage, If you live in the state of Indiana this might be the alternative insurance you are needed to lug. This set is comparable as well as is meant to aid you obtain your certified restored after it has actually been put on hold due to your infraction. (Mon-Fri, 8am 5pm PST) for a of a low-cost SR22 insurance, or submit this type: - insurance companies.

What is an SR-22? An SR-22 is a certificate of monetary duty required for some drivers by their state or court order. An SR-22 is not an actual "kind" of insurance, but a kind submitted with your state. This type works as evidence your vehicle insurance coverage meets the minimum obligation coverage required by state law.

Generally, it is needed by the court or mandated by the state only for specific driving-related offenses.: DUI convictions Careless driving Crashes created by without insurance motorists If you need an SR-22/ FR-44, the courts or your state Electric motor Lorry Division will certainly alert you.

Existing Clients can call our Client service Division at ( 877) 206-0215. We will certainly examine the coverages on your policy and begin the procedure of submitting the certificate on your behalf. Exists a cost related to an SR-22/ FR-44? The majority of states charge a level charge, yet others need a surcharge. This is an one-time fee you must pay when we submit the SR-22/ FR-44 - driver's license.

The Ultimate Guide To What Is Sr-22 Insurance Quotes?

A declaring cost is charged for each and every private SR-22/ FR-44 we submit. For instance, if your partner gets on your plan and both of you require an SR-22/ FR-44, then the filing cost will be billed twice. department of motor vehicles. Please note: The charge is not included in the price quote because the filing charge can vary.

Just how lengthy is the SR-22/ FR-44 valid? Your SR-22/ FR-44 must be legitimate as long as your insurance plan is energetic. If your insurance plan is canceled while you're still required to lug an SR-22/ FR-44, we are called for to notify the correct state authorities. If you don't maintain continual protection you could lose your driving benefits.

HOW MUCH TIME IS AN SR-22 VALID? Each state has its very own needs for the length of time that an SR-22 should remain in location. sr22 insurance. As long as you pay the needed costs and to maintain your plan active, the SR-22 will certainly continue to be in impact up until the demands for your state have actually been fulfilled.

division of motor vehicles insurance no-fault insurance insurance division of motor vehicles

division of motor vehicles insurance no-fault insurance insurance division of motor vehicles

It is similar to an SR-22, yet an FR-44 typically calls for greater liability limitations - auto insurance. Many states require a small declaring charge when an SR-22 is first filed.

At Safe, Car, we comprehend that purchasing cars and truck insurance policy protection can be demanding and costly. underinsured. You can call a devoted Safe, Auto customer service agent at 1-800-SAFEAUTO (1-800-723-3288) to request an SR-22 be filed.

Not known Facts About Can I Get An Sr22 When I Don't Own A Car? - The Zebra

If they will certainly not cover you, there are alternative insurance policy suppliers such as,,, and. In order to get your insurance policy protection up to day, you will certainly require to obtain a quote for SR-22 insurance coverage.

You can obtain a cost-free quote simply loading the Continue reading kind on the top of this web page, and in a couple of mins you'll contrast several cost effective SR-22 insurance policy quotes. Relying on your state, as well as the factor for your offense, you may have to file extra alternate forms. SR-21 Insurance coverage, This is a comparable type yet it shows that you have evidence of automobile insurance policy.

SR-50 Insurance policy, If you reside in the state of Indiana this may be the different insurance coverage you are called for to carry - no-fault insurance. This set is comparable and is meant to help you obtain your accredited restored after it has been suspended as a result of your offense. (Mon-Fri, 8am 5pm PST) for a of an inexpensive SR22 insurance, or submit this type:.

An SR-22 is not a real "kind" of insurance policy, but a form submitted with your state. This form offers as proof your auto insurance coverage policy meets the minimal responsibility insurance coverage needed by state legislation.

bureau of motor vehicles driver's license department of motor vehicles auto insurance driver's license

bureau of motor vehicles driver's license department of motor vehicles auto insurance driver's license

Normally, it is called for by the court or mandated by the state only for particular driving-related violations.: DUI sentences Careless driving Mishaps created by uninsured chauffeurs If you need an SR-22/ FR-44, the courts or your state Electric motor Automobile Division will notify you.

The Facts About Indiana Sr-22 Insurance (Quotes And Rankings) - Clearsurance Uncovered

Present Consumers can call our Customer support Division at ( 877) 206-0215. insurance. We will certainly assess the insurance coverages on your plan and begin the procedure of filing the certificate on your part. Is there a fee connected with an SR-22/ FR-44? Most states charge a flat charge, however others call for an additional charge. This is an one-time cost you need to pay when we file the SR-22/ FR-44.

A declaring charge is charged for each individual SR-22/ FR-44 we file. For instance, if your spouse gets on your policy and both of you require an SR-22/ FR-44, after that the declaring cost will certainly be charged two times. Please note: The fee is not included in the rate quote since the filing cost can differ.

For how long is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 should stand as long as your insurance coverage is active. If your insurance coverage plan is terminated while you're still called for to carry an SR-22/ FR-44, we are required to inform the proper state authorities. If you do not preserve continuous insurance coverage you could lose your driving advantages.

THE LENGTH OF TIME IS AN SR-22 VALID? Each state has its very own demands for the length of time that an SR-22 must be in area - sr22 insurance. As long as you pay the necessary premium as well as to maintain your plan energetic, the SR-22 will remain basically until the needs for your state have been satisfied.

It is similar to an SR-22, however an FR-44 typically calls for greater responsibility restrictions. The majority of states require a small filing charge when an SR-22 is initial submitted.

The Facts About Sr22 Insurance: Cost & Cheap Sr-22 Insurance Quotes - 101 Revealed

https://www.youtube.com/embed/tGOveRGlKRMAt Safe, Automobile, we recognize that looking for automobile insurance coverage can be stressful as well as costly. You can call a dedicated Safe, Auto client service agent at 1-800-SAFEAUTO (1-800-723-3288) to ask for an SR-22 be filed (insurance).